Axis Bank

Young Bankers Program

Start your career as an Assistant Manager.

Earn While You Learn

- Starting Salary of 4,42,000 P.A(inclusive of Non-Cashable Loan Benefits & Bonuses)

Post Graduate Diploma from University

For Batch 1 - We are seeking applications from Punjab & Haryana - other locations will open soon

*Admission letter authorized by Axis Bank on selection and Offer letter on successful completion of campus training and confirmation of successful completion of 1 year program. Past record is no guarantee of future prospects.

*Gross CTC. This is inclusive of non-encashable loan benefits, indicative performance bonus.

Loading...

Why Choose Axis Bank Young Bankers Program

Axis Bank Young Bankers Program provides fine blend of campus training, internship and on-the-job training to help kickstart a successful banking career.

Fast track Your Career with Axis Bank

Axis Bank is a leading private sector bank in India, offering a full range of personal and corporate financial services.

Earn While You Learn

Start earning a stipend from the 1st month and salary from the 5th month after joining Axis Bank. Start recovering your training investment early.

Enriching Learning Journey

Build your knowledge, skills and attitude through an experiential learning process from peers and expert industry mentors.

Starting Salary of 4.42 LPA**

MBA level starting salary. (inclusive of Non-Cashable Loan Benefits & Bonuses)

Join as an Assistant Manager

On completion of the program join Axis Bank as a Branch Relationship Officer (BRO).

PG Diploma from NITTE university

Get 1 year post graduate diploma in Banking Services from NITTE university.

Steps to start a career withAxis Bank

1. Online Registration

Register yourself by completing your online application form on this site. Please note, you application will be considered for further processing only when it is completed, including the payment of application fee of Rs.118 inclusive of GST. This application fee is for the purpose of the assessment and does not guarantee selection for the program or employment with Axis Bank.

2. Online Assessments

Verbal Ability, Analytical Ability, Numerical Ability, Written English Test, Listening Comprehension Test.

3. Career247 Interview

Virtual Interview with Career247 Faculty panel

4. Selection & Issue of Admission Letter

Enroll and Pay

EligibilityCriteria

Eligible if

Qualification

- Graduates with aggregate of 50% and above in all semesters of Graduation.

- Candidates in the Final Year of their Graduation/Post Graduation who have appeared for their examination & are awaiting results are also eligible for the program. However, Original Final Year mark sheet & degree certificate will have to be submitted on joining the academy.

- Graduation Degree (10+2+3 patterns) is compulsory

Age limit

Candidates must not be more than 28 years to qualify for admission.

Not Eligible if

Conflict of Interest

- You have a relative working at Axis Bank in accordance with the relative hiring policy of the Bank. Moreover, if two relatives get selected for the program, candidate with lower assessment score will have to withdraw their application.

- You are not eligible if your age is more than 28 years.

Disciplinary Proceedings

- You have been subjected to any disciplinary proceedings by your previous employer(s) at any time.

- You have ever been proceeded against or convicted under any criminal statutes or in a consumer forum.

- Any legal action is pending or proposed to be initiated against you.

Documents Required

Address Proof/Identity Proof/Signature Proof

- • Passport

- • Driving License

- • Voters Identity Card

- • NREGA Card

Birth Date Proof (Any 1 document)

- • Passport

- • Driving License

- • Birth Certificate

- • Election Card/Voter Card

ID Required

- • PAN Card (Mandatory)

- • Aadhaar Card issued by UIDAI (Mandatory)

Academic Certificates (All Original Documents)

- • 10th SSC & 12th HSC Mark sheets

- • Graduation Certificate, Mark Sheet

Program Snapshot

Axis Bank Young Bankers Program provides fine blend of campus training, internship and on-the-job training to help kickstart a successful banking career.

Invest

- Total fee structure for the course is Rs.2,37,288 + GST @18% Rs.2,80,000.

- This fee includes Tuition Fees, boarding & hostel fee, food expenses, Infrastructure usage, Health Insurance (Max Coverage of 1 Lakh Rupees), Tablet expenses & GS.

Learn

- Classroom Training for a period of 4 months

- Internship @ Axis Bank Branch for a period of 3 months

- On-the-Job Training @ Axis Bank Branch for a period of 5 months

Earn

- Stipend – Rs.5,000 per month during 1-4 months of classroom training

- Salary – from 5th month after joining Axis Bank

Grow

- Get absorbed by Axis Bank at an Assistant Manager Grade on successful completion of the 4 months classroom training and 3 months internship

- Start drawing a salary of 4.42 LPA* (inclusive of Non-Cashable benefits)

Payment Options

Total Fee : ₹2,37,288 + GST @18% - ₹2,80,000

| Fees type | Fees |

|---|---|

| Registration fees | ₹4,237 + GST (₹5,000) |

| Installment 1 | ₹1,20,738 + GST (₹1,42,471) (at the time of admission) |

| Installment 2 | ₹1,12,313 + GST (₹1,32,529) (start of term 2) |

*EMI/Loan Options will be available from Axis Bank.

- Loan available for balance fee payment of Rs 2,35,169 + GST through Axis Bank at around 13% rate of interest

- EMIs will start 6 months after starting the job and will get deducted from your salary

Course Structure

- Retail Banking Solutions

- English & Communication

- Banking Sales & Service

- Branch Operations & Compliance

- IT & Payment Solutions

- Relationship Management

- Digital Banking & CBS

- Financial Planning

- Business Credit Assessment

- Trade Finance & Forex

- Retail Banking Solutions

- English & Communication

- Banking Sales & Service

- Branch Operations & Compliance

- IT & Payment Solutions

- Relationship Management

- Digital Banking & CBS

- Financial Planning

- Business Credit Assessment

- Trade Finance & Forex

Learning Journey

Fresh Graduates

4 months

- Term 1: Focuses on building foundational blocks, understand Banks product & services.

- Term 2: Develops customer engagement, sales skills, & maps products to customer needs.

3 months

- Internship: Get hands-on experience with banking roles.

- Continue building knowledge through guided self-learning on the LMS (Learning Management System).

5 months

- On the Job Training: Apply classroom learnings in real scenarios.

- Serve customers, manage targets, and handle live challenge.

PGD Degree

Fresh Graduates

4 months

- Term 1: Focuses on building foundational blocks, understand Banks product & services.

- Term 2: Develops customer engagement, sales skills, & maps products to customer needs.

3 months

- Internship: Get hands-on experience with banking roles.

- Continue building knowledge through guided self-learning on the LMS (Learning Management System).

5 months

- On the Job Training: Apply classroom learnings in real scenarios.

- Serve customers, manage targets, and handle live challenge.

PGD Degree

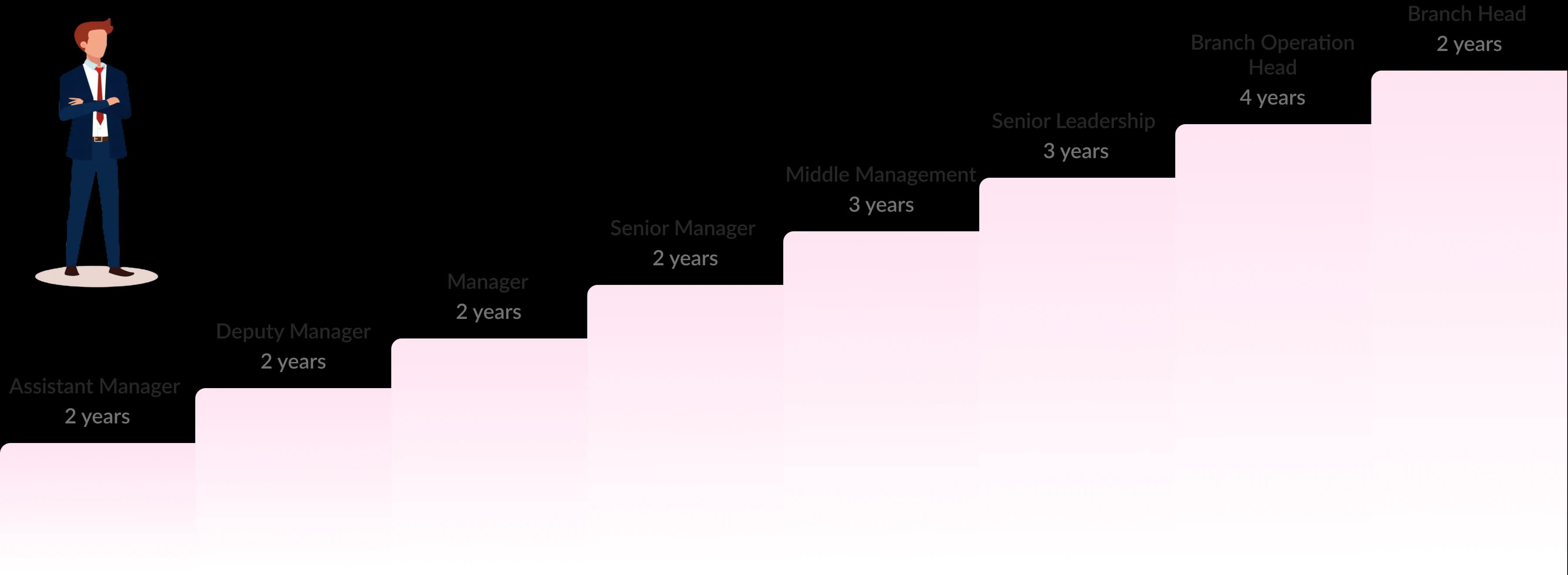

Career Path

Frequently Asked Questions

Disclaimer

- Before applying, the candidate should ensure that he/she fulfils the eligibility and other norms mentioned.

- In case, it is detected at any stage of the selection that a candidate does not fulfil the eligibility norms and/or that he/she has furnished any incorrect/false information certificate/documents or has suppressed any material fact(s), his/her candidature will stand cancelled. If any of these shortcoming/s is/are detected even after admission appointment, his/her admission / services are liable to be terminated.

- In case, you have worked previously with Axis Bank, and if basis rehire policy of the bank, you are not found eligible to be rehired via this program, then bank will cancel your application in accordance to the rehire policy of the Bank.

- Decision of the Bank in all matters regarding eligibility of the candidate, the stages at which such scrutiny of eligibility is to be undertaken, the documents to be produced for the purpose at the time of conduct of examination, interview, selection and any other matter relating to recruitment will be final and binding on the candidate. No correspondence or personal enquiries will be entertained by the bank in this behalf.

Note

Shortlisting at any stage during the application or selection process will be done basis bank's criteria. The student's education qualifications and background will be verified by the Bank through an external agency. The details provided by the student at the time of application/selection need to be authentic which are subject to verification. Once the Agency confirms the authenticity of these details only then the candidate will be considered for further process of selection/ employment in the Bank. At the time of joining the bank, the candidate will have to submit a "self-declaration" medical fitness form.